Господдержка предприятий-производителей строительных материалов

The EU carbon tax could cost Russian suppliers of iron, steel, aluminum, fertilizers at least € 1.1 billion a year, when the tax starts to be levied at 100%. This follows from the calculations of RBC, certified by the Ministry of Economic Development.

Suppliers of Russian goods with a large carbon footprint will pay at least € 1.1 billion a year to the EU budget when European authorities begin to fully levy the cross-border carbon tax officially proposed by the European Commission on July 14. This follows from the calculations of RBC according to the methodology confirmed by the Ministry of Economic Development. The agency is responsible for consulting with the EU on the carbon tax.

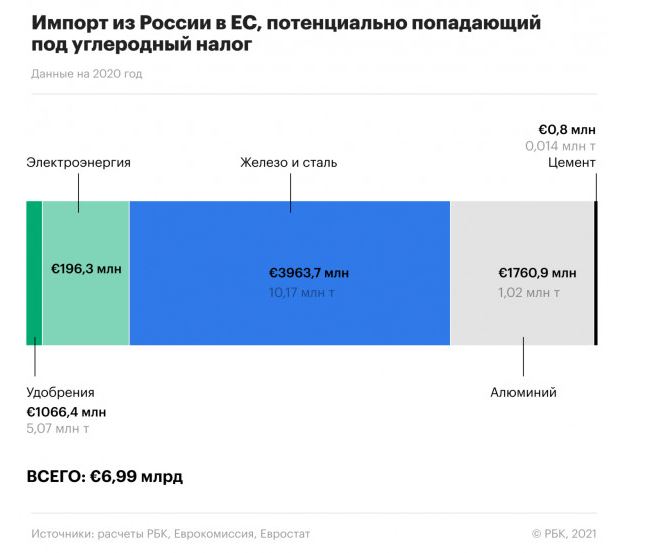

Based on the volume of imports in 2020, the tax will affect Russian supplies to the EU in the amount of almost € 7 billion (7.3% of last year's total imports of goods from Russia to the European Union), and in kind - 16.3 million tons (in 2019 - 18.4 million tons), follows from the Eurostat foreign trade database. For Russia, the tax will actually be equivalent to an additional ad valorem duty of 16% of the value of goods - € 1.1 billion from € 7 billion.

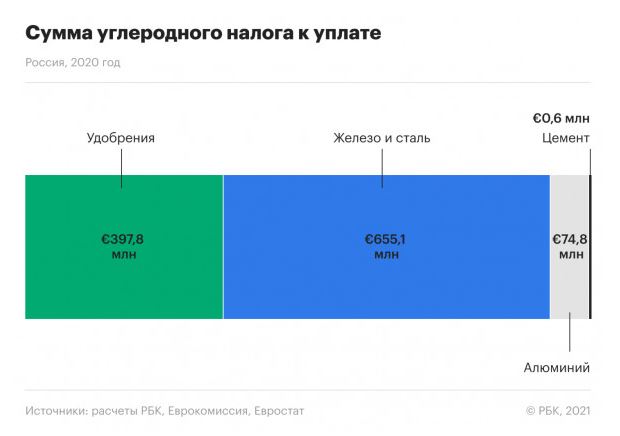

The most to be paid for the import of iron and steel from Russia - € 655 million, nitrogen fertilizers - € 398 million, which reflects the higher volumes of supplies in tons, as well as indicators of the carbon intensity of these products.

What tax is the EU going to levy

The European Union wants to impose a special tax on importers of dirty goods - the first in the world of its kind - in order to reduce greenhouse gas emissions by 2030 by no less than 55% compared to 1990 levels, as well as reduce global greenhouse gas emissions, as additional costs are designed to encourage manufacturers to reduce harmful emissions. The draft of the relevant regulation of the goods on which the carbon tax will be levied defines:

cement (four codes of the European commodity nomenclature);

electricity (one code);

fertilizers (five codes, including ammonia, nitrogen fertilizers and nitrogen-containing complex fertilizers);

iron and steel (12 codes, including rails for railways, pipes, metal structures, tanks);

aluminum (eight codes, including wire, aluminum sheets, foil).

In the future, the carbon tax may be extended to other goods, such as petroleum products (which the European Parliament called for in March). Last year, more than 60% of European imports from Russia (€ 60.1 billion out of € 95.3 billion) came from energy.

The carbon tax can be fully operational only starting from 2035, it follows from the conclusion of the European Commission experts (.pdf), who recommended this option of introducing the tax as the preferred one (in total, six options are considered). It assumes that the import carbon tax will gradually increase to 100% in 2026–2035 as the free emission credits distributed among the participants in the European carbon market are phased out.

How future Russian payments were estimated

The calculation of the indicative carbon tax for Russian suppliers (see infographic) is based on the physical volumes of supplies of goods subject to the published draft cross-border carbon regulation from Russia to the EU for 2020, the current price of a carbon unit under the European emission trading system EU ETS (about € 50 / t) and EU benchmarks for the carbon intensity of the respective products (cast iron, cement, ammonia, etc.). Benchmarks are reference values for greenhouse gas emissions per tonne of product produced, set by the European Commission for the purpose of determining free emission quotas (they are free within the benchmark). This approach is consistent with the internal calculations of the Ministry of Economic Development, the director of the department for trade negotiations of the ministry, Ekaterina Mayorova, told RBC.

“Although the European Commission intends to charge importers based on their actual greenhouse gas emissions during production, there is no systematic measurement of the carbon footprint in Russian industrial companies, and it’s unclear to what extent the EU will accept data from Russian manufacturers,” Mayorova said. It follows from the European Commission's draft that an “authorized applicant” (a representative of one or more importers) will submit an annual declaration with data on the volumes of greenhouse gas emissions accompanying the production of the imported product.

The EU benchmarks were calculated as follows: take the 10% of the most emission-efficient installations - for example, for the production of steel; the volume of their emissions is determined. The benchmark for steel is based on the average emissions of these manufacturers. The carbon intensity reference values for 2021–2025 are set by EU law. For the period 2026–2030, the benchmarks will be updated - reduced to reflect technical progress.

How is the carbon footprint taken into account?

Public Russian manufacturers such as Rusal or NLMK are already disclosing their carbon footprint, but not all companies in Russia are following their example. Until recently, in the Russian regulatory framework, there were no obligations of companies to provide data on greenhouse gas emissions (it appeared in the adopted, but not yet entered into force, law on limiting greenhouse emissions, and will only work from 2023), says the deputy head of the department special projects of the Department of Research of the Fuel and Energy Complex of the Institute for Problems of Natural Monopolies Aleksey Faddeev.

In addition, there is a methodological complexity: the carbon footprint can be taken into account both for "direct" emissions at a specific enterprise (the so-called scope category 1), and with additional accounting for "indirect" emissions that occurred at the previous stages of the technological chain - in the production of electricity, heat (category scope 2), raw materials and components (scope 3), which were used in the enterprise, the expert adds. The European Commission's draft carbon tax bill proposes to take into account “direct” emissions (including heat) and “indirect” emissions (electricity) when they are “significant” (precise criteria are planned to be determined later).

What is the likelihood that the tax will be higher

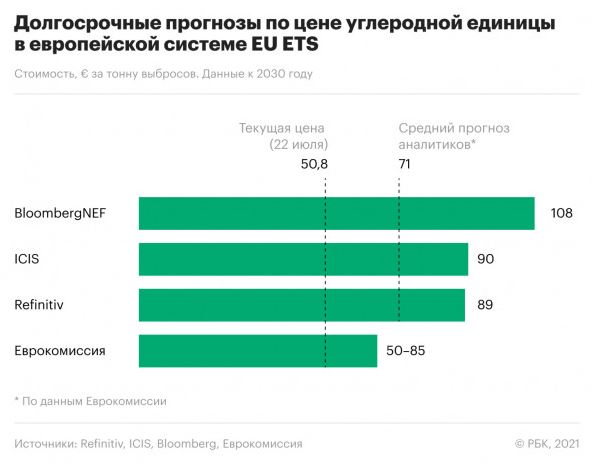

Mayorova notes that the presented calculation is conservative, since, firstly, it is based on the volumes of supplies in tons in the pandemic 2020 (when these supplies for many commodity groups sagged), and secondly, it is guided by the prevailing price of emission quotas in the European Union for in recent months (about € 50 per tonne of CO2-equivalent), and carbon market participants predict a price increase by the end of the decade. The calculation does not take into account the import of electricity, since the European Commission itself indicates that the carbon tax on electricity will be calculated in a special way.

It follows from the project of the European Commission that the price of a ton of CO2 for importers will be equal to the average price determined at auctions within the framework of the EU emission trading system for the previous week. In 2021, a price rally is observed in the European carbon market: if before the pandemic the carbon unit in the EU ETS system traded at € 20, now its value has risen to record levels - more than € 50. Most industry experts expect further growth in this market: according to the European Commission (.pdf), the consensus forecast for a carbon unit price in 2030 is € 71 / t (see table). Market participants polled by Refinitiv in May predict a price of € 89 by 2030. But it is rather difficult to predict this price, and some analysts note that in terms of volatility, low predictability and importance for industry, the price of quotas for ETS is comparable to oil prices, notes Alexey Faddeev.

Which countries will still suffer losses

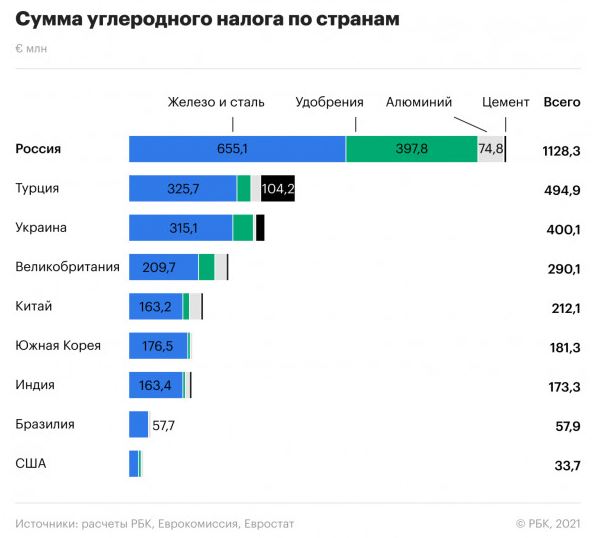

According to the European Commission, potentially the largest tax will affect Russia, Ukraine, Turkey, Belarus, Albania, Egypt, Algeria, Morocco (amounts are not named).

The United Nations Commission on Trade and Development (UNCTAD) in a recent study confirms (.pdf) that Russia, along with Ukraine, will suffer the greatest losses.

According to RBC's calculations, Russia's annual losses from the carbon tax (€ 1.13 billion) will be about the same as the sum of the losses of the next on the list of Turkey, Ukraine and the UK.

The carbon tax mechanism will significantly change, and in some cases even stop traditional bilateral trade between Russia and EU countries such as Germany, Economic Development Minister Maxim Reshetnikov said on July 23 on the sidelines of the G20 climate and energy ministerial meeting in Naples. “I am sure there are alternatives to such a high price for achieving climate targets,” Reshetnikov said.

How Russia intends to fight against the collection

Russia will try to prove that the proposed EU carbon levy is incompatible with the rules of the World Trade Organization (WTO), it follows from the public comments of the Ministry of Economic Development. “For almost a year and a half, while the project was being developed, colleagues from the EU assured the whole world that the letter and spirit of the WTO agreement would be fully observed. Today there is no certainty about this, ”Maxim Reshetnikov said on July 14.

In general, in order to justify a contradiction with WTO norms, it is necessary to show that supplier countries are discriminated against - for example, if foreign companies have to pay a tax, but there is no such tax for the EU's own companies, explains Alexander Daniltsev, director of the HSE Institute for Trade Policy. The EU has repeatedly emphasized in the proposed draft law that the favored treatment for importers will be no worse than for European producers buying carbon credits in excess of free limits.

The line of defense of the European Union from the point of view of the WTO rules is clear: European producers pay for carbon quotas, which reduces their competitiveness, which means that foreign suppliers must pay, a federal official familiar with the climate agenda told RBC. However, the proposed mechanism will still violate the obligations of the European Union within the WTO, he said. “In fact, the EU intends to establish additional import duties in excess of the bound levels for WTO obligations [marginal rates above which tariffs cannot be raised]. In addition, they will continue to violate the national regime, since the mechanism for importers will still differ from that adopted for domestic producers: importers will have to buy emission certificates in advance; national producers will still have benefits, support measures, etc. ", - says the interlocutor of RBC.

To appeal only to the violation of WTO norms is a bad option for Russia, says Vladimir Chuprov, project director of the Russian branch of Greenpeace. Today, in 65 countries of the world, one or another price scheme for greenhouse emissions is in effect, including China recently launched the national emissions trading system, he notes. “Russia still looks like a blank spot on the global map of carbon markets. We can say that the country is 15 years behind the leaders, ”Chuprov says. According to him, the reasons for the lag lie in the rental model of the country's economy, where added value is still formed due to the relatively cheap extraction of fossil fuels. Mitigating the losses of Russian exporters from EU carbon regulation is possible: it is a reduction of the carbon footprint in products through the introduction of energy efficiency measures and the replacement of fossil fuels with low-carbon energy sources, says a Greenpeace spokesman.

Source: https://www.rbc.ru/